Twice a month, on the 10th and 25th, you’ll zero out the Income account by transferring the funds into the other four. Traditional Profit First teaches that you should have five separate bank accounts for each category: Income, Profit, Tax, Owner’s Pay, and Operating Expense. Traditional benchmark: 30% of gross revenue Operating Expenses - This goes to paying your regular operating expenses and additional investments you make for your business (hello coaching, courses, and new office furniture). Traditional benchmark: 50% of gross revenue And, voila! Consistent, reliable income from your business.

If there’s more money set aside than your salary, you leave the rest! That’ll go towards your next paycheck. Owner’s Pay - A fund to draw a regular salary from. Traditional benchmark: 15% of gross revenue

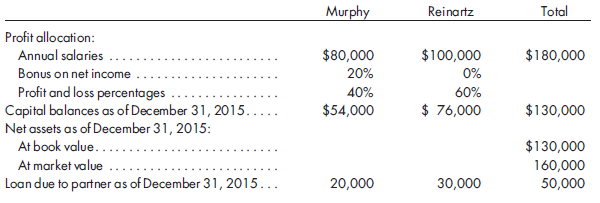

PROFIT FIRST ALLOCATION PERCENTAGES PROFESSIONAL

Always consult a tax professional for an accurate assessment of your personal situation.

Tax -Save up for your income tax liability. Profit - This acts as an emergency cash cushion, but you also get to pay yourself 50% of whatever has built up in this category every quarter as a bonus! It’s your reward for running a profitable business! Traditional benchmark: 5% of gross revenue Profit First teaches us to take all the money that comes into our business and allocate it out to four different categories based on predetermined percentages: So how does someone practically adapt the profit first method? That’s where the second principle comes in: you allocate your income as it comes in! Income - Profit = Expenses Allocation of Income If there’s not enough, we have too many expenses and need to make cuts! We take our income, prioritize a percentage for profit, and take whatever’s left and use that to pay our expenses. However, Mike suggests we flip the script. Traditionally, we take our income, subtract our expenses, and name the leftover “profit” (if we’re lucky enough to have any). What does profit first even mean? Mike teaches us to prioritize our profit before paying any of our expenses. The system is defined by two main principles: profit first and allocation of income. Profit First is a money management system ( and a book, which I recommend you read!) developed by small business finance expert Mike Michalowicz.

PROFIT FIRST ALLOCATION PERCENTAGES HOW TO

Let’s talk about Profit First and how to learn to adapt the profit first method for online solopreneurs. But I’m also going to show you how to take a generalized system made for traditional businesses and make it work for digital entrepreneurs like you! Today, I’m going to walk you through a revolutionary system that is guaranteed to change your financial story when implemented correctly. Money management is a touchy subject for some people, but it’s also something that we all need to be talking about! Cash flow is the lifeblood of small business, so we’re going to start treating it as such. If you’re a “bank balance budgeter,” you’re going to love this.

0 kommentar(er)

0 kommentar(er)